Webinars and Workshops

Events

-

-

Federal R&D Tax Credits

Why is the opportunity of "free" money so obscure? Who is eligible? What has changed to make it accessible? Understand how the process works to capture and utilize the credits. Understand the 4 Part test. Short and long term benefits to early stage companies.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_5GfTChtWScqMdEW-j8v5MA -

The Entrepreneur’s Guide to Negotiating a Venture Capital Financing

We will review the terms negotiated in a typical venture capital financing and discuss different deal structures for early stage financing.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_8c1SJmiwS1CLQ9RMhVbTAg -

-

You are not a Unicorn YET!

Every start up feels they have Unicorn in the making when they launch. In reality they have a Tiger by the tail. The difference between success and failure is normally easy to see in hindsight but what if we could codify the outcome in advance. Brian Mac Mahon is the owner of Expert DOJO, the biggest investor in startups in Southern California by deal numbers, will help us understand the drivers of failure so that we can plan for success. Don't miss this important session to help you plan out your personal Unicorn.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_8khYaQ5ZT9mFZuv6ZLmV4w -

Entrepreneurial Marketing

How and why is marketing in a startup different than marketing in an established business? What, in fact, is being marketed by a startup? The company's product or service ... or -- perhaps -- the company itself? And are the startup's marketing activities aimed only at potential customers for its product or service? Or are there other significant audiences receiving -- and reacting to -- the marketing signals that the startup is generating? And do all these audiences react similarly to each marketing signal? Or could investors, channels, strategic partners, or even key new team members the startup is recruiting have quite different -- possibly even contradictory -- views of a given marketing initiative than the potential customers that were its "intended" audience? This Webinar will describe the multi-dimensional chess game of marketing in a startup -- where every move has multiple, entangled levels of impact on multiple players who all need to win for the startup to succeed.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_Ix3zw-QLThW4zgmOLJ6vZQ -

Sales Strategies for Start-Up’s

Sales drives revenue in every business. You will learn the basics on how to create a winning sales strategy and establish standardized sales processes.

We will teach you how to take your business from the owner as Chief Sales Person, to building and scaling a sales team that drives sustainable, and profitable, revenue growth.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_QlhyAuIaQYud296RXJA8Ew -

New Product Development

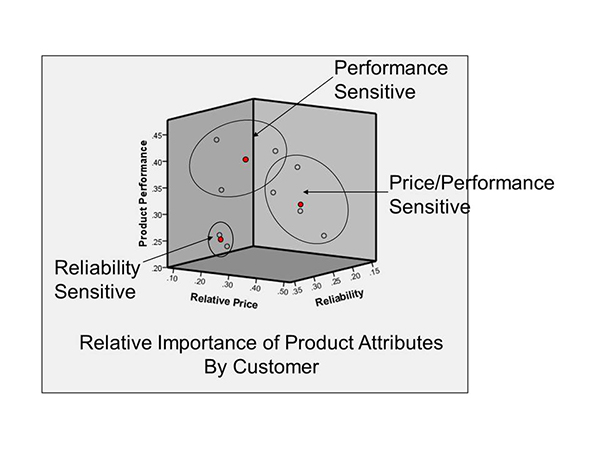

Product Management can be defined as the general business structure within a company that supports and manages all the activities related to developing, marketing and selling a product – or a family or group of products – throughout the entire product lifecycle, from concept ideation through end-of-life. Product management's role in a startup, however, typically focuses primarily on the front end of the product management process. Furthermore, in startups founded by inventors, scientists, engineers and other technical or subject matter experts, many front-end product management tasks are initially attempted or even completed before anyone with marketing or sales experience joins the team. But the work of conceptualizing the product, estimating the market size and revenue potential, understanding segmentation, and developing an initial penetration strategy is difficult to do successfully without a "product owner" who can bring a marketing and sales perspective to these tasks, while working effectively and collegially with R&D to capture the Voice of the Customer in the product design. This Webinar will describe how "product owners" accomplish that mission in a startup, along with introducing some key tools and resources that can help.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_K6AxPgASQnqFQJ-3YtXwnA -

The Ins and Outs of a Preferred Stock Term Sheet – What Every Entrepreneur Needs to Know When Negotiating a Preferred Stock Financing

You have reached a milestone and have a Preferred Stock Term Sheet on your desk, what do you do next? In this webinar we will cover what every Entrepreneur needs to know when negotiating a Preferred Stock Financing. Make your financing work for you.

This is the event link. It ONLY works for registrants.

https://us02web.zoom.us/webinar/register/WN_z43JRO6IScOKhnd74-OYZg -

-

Business In Words or Business By Numbers?

Entrepreneurs have strong natural inclinations toward using persuasion as opposed to calculation to convince customers and investors to give them money. This webinar explores why this is, and helps entrepreneurs understand how Finance differs from mere Accounting to help them build the persuasive case they really need.

Event Link - It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/89655827045?pwd=ak10eGVwTFFMQzN4MnRqZHNzdjJ0UT09 -

How to tell your story!

What is the best way to get and capture an angel investors interest in a deal? It starts with ensuring the investor understands the business problem you are solving and why you are different and better than existing options today. Just as important, the entrepreneur needs to build rapport with the investor and tell his/her story in a compelling way. This webinar will provide examples and ways to tell a compelling story and help make it easier to fund a company.

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/84490158141?pwd=WUhBNFd4VXFEbXpjQXRCcFR4L2d0UT09 -

Business Model Canvas

A visual representation of the various elements of your Business Model on a Lean Canvas which allows you to:

1. See the relationships among the parts of your model

2. Identify hypothesis, assumptions and risks

3. Plan validation testing (market, channels, pricing)

4. Find ways to add value or reduce cost

5. Brainstorm market disruption strategiesEvent Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/83750620098?pwd=V0NXTzBNcFhMRU1JNnZWdWhham9tdz09 -

What makes a wining pitch!

Dissecting the best and worst of the most famous pitch decks and getting down to the essential holy grail. You don't want to miss!

On April 4th Boston University's Questrom School of Business and Innovate@BU will host Barbara Russell in a webinar discussing how to craft a pitch deck that optimizes your chance as a founder to get funded. She is one of the top thought leaders on pitch decks and pitching, having just wrapped up her 22nd pitch competition as a judge since COVID began (all virtual). Barbara has honed her pitch deck and presentation skills as an investment banker, a very active angel investor, an adjunct professor (MIT, Babson, and now, U Mass) focused on early-stage companies - now having seen what she estimates to be a couple thousand pitches!

In this webinar, you will learn the key elements of what goes into a deck, how to present them efficiently, effectively, and eloquently. And then, how to employ storytelling skills to capture the audience’s attention. How to win over VC’s, angels, or other sources of capital that hear pitches ALL DAY LONG. She will also take you through some of the most famous pitch decks ever created (Uber, Coinbase, AirBnB, Tesla, etc.) and dissect them – and be able to point out the good, the bad and THE UGLY!!! What TO DO, and what TO AVOID!

It will be a fun ride. Strap in.

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/82888089633?pwd=UWU2ZlEyVEYvRndtQzlsUHJ3VFdkdz09 -

Data privacy compliance and cybersecurity

A Primer on Privacy and Intellectual Property: What You Need to Know At Formation and Before Going to Raise Money

- Briefly discuss the types of intellectual property and how you need to protect it before approaching VCs

- General Privacy Law considerations to implement and a time line for implementing, from immediate to where you need to be before closing a price round or other fundraising, discuss some of the more noteworthy laws and contractual obligationsEvent Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/81604258269?pwd=UDlqNHBsVXRYdnJTYTBKbkh5b2FtQT09

-

Position To Win

Deep dive into how to craft a compelling value proposition from the customer's point of view. You don't want to miss!

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/86878137908?pwd=dlJPZmw1b09tQ1JyMlcxUCtBUTVCZz09 -

Translational Medicine: Innovations and Patents

This webinar focuses on intellectual property management and patentability of inventions in translational medicine.

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/88409150763?pwd=UUoweHVjKzNhdVptN1JXZTQ0U3VrZz09 -

Perform your own IP diligence

How to get your IP in order before raising money, including confirming employment/contractor agreements, NDAs, ownership, identification of trade secrets, filing patent and trademark applications, and overall timing.

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/86361310778?pwd=SU1iMU0xMFp0ajFWM2d3OEFtZU9MZz09

-

-

FDA For Life Science Companies: The Insiders Guide to FDA Approval

Kwame Ulmer is a 12 year veteran of the FDA and currently works as a regulatory strategist and investor. You will learn how to develop a regulatory strategy, maximize your interactions with the FDA and efficiently get your product approved. The presentation is geared towards helping C-Suite executives understand the key levers to drive premarket approval and compliance attractive to investors. The presentation will also discuss overcoming the regulatory challenges during COVID.

Event Link – It ONLY works for Eventbrite Registrants:

https://us02web.zoom.us/j/83464074974?pwd=Z0Y0aHBEZzVDVXY5WE1KNDVyeUlFZz09

-

-

Accelerate Growth

Andy Wang, GM of Lark (part of ByteDance, the parent company of TikTok), will discuss how startups can accelerate their growth and take their productivity & engagement to the next level through the next-generation collaboration platform - Lark.

Join us to learn more.

Event Link – It ONLY works for Eventbrite Registrants: https://rebrand.ly/b2xlark

-

Structuring your Startup and Negotiating Financing

Structuring your Startup and Negotiating Financing. The following topics will be covered:

- What kind of legal entity investors invest in

- Key agreements to put in place with your team and others pre-fundraising, and their basic terms

- What is intellectual property and how to protect it with agreements and registration

- Pre-seed and seed financing: pre-requisites and important terms to negotiate

- A rounds: pre-requisites and important terms to negotiate

- Later Stage rounds: requirements and important terms to negotiate

- Strategic financing - key negotiating pointsEvent Link – It ONLY works for Eventbrite Registrants: https://rebrand.ly/c68job2

-

-

Patent Readiness for Investors – IP Due Diligence – What Investors Want to See

IP Due Diligence is a crucial component of most investment deals. Learn about the various aspects of IP that investors want to see. Companies are often valued on the strength of their Patents and other IPs. Companies with stronger IPs are often favored for bigger investments. The strength of IPs are evaluated through an IP Due Diligence process. Our short and entertaining webinar will give you a good understanding of what to expect in an IP Due Diligence process and how to best prepare your company for winning investments from Angel and VC investors.

Event Link – It ONLY works for Eventbrite Registrants: https://l.pismoventures.com/B2XSS23-Webinar1

-

Top Legal Mistakes that can Kill a Startup

ALL TIMES ARE PST.

Top Legal Mistakes that can Kill a Startup

Veteran corporate attorney Ken August will discuss some of the legal issues which can be traps for the unwary, and which can end up killing a startup company by rendering it very difficult or impossible to take in capital investment, or which can create similar problems in the future. He will also provide some helpful tips for how to avoid these kinds of mistakes.

Event Link – It ONLY works for Eventbrite Registrants: https://l.pismoventures.com/B2XSS23-Webinar2